irs unveils federal income tax brackets for 2022

Over 83550 but not over 178150. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

2022 And 2023 Tax Brackets Find Your Federal Tax Rate Schedules Turbotax Tax Tips Videos

The internal revenue service irs is responsible for publishing the latest tax tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

. Long-term tax-exempt rate for. 12 for incomes over 11000 22000 for married couples filing jointly. November 12th 2021 under General News Law Enforcement News PeruRegional History.

This is a jump of 1800 from. Irs unveils federal income tax. 2022-2023 Tax Brackets And.

37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. Federal Income Tax Brackets 2022. The IRS recently released the new tax brackets and standard deduction amounts for the 2023 tax year meaning the return youll file in 2024.

10 for incomes of single individuals with incomes of 11000 or less 22000 for married couples. 25900 Single taxpayers and married individuals filing. There are seven federal income tax rates in 2022.

Married couples filing jointly. 2055 plus 12 of the excess over 20550. The IRS has released its 2023 tax brackets a bracketed rate table for the IRS federal income tax rates and updated standard deduction amounts and there are a number of.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a. 2022-17 TABLE 3 Rates Under Section 382 for September 2022. 8 rows There are seven federal income tax rates in 2022.

For 2022 theyre still set at 10 12 22 24 32 35 and 37. 10 percent 12 percent 22 percent 24. 7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your.

Adjusted federal long-term rate for the current month. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. WASHINGTONThe threshold for the top federal income-tax bracket in 2022 will climb by nearly 20000 next year for married couples and that 37 rate will apply to income.

Importantly the 2021 brackets are for income earned in 2021 which most people will file taxes on before. 9615 plus 22 of. Single filers may claim 13850 an increase.

9 rows Income Tax Brackets for Married Taxpayers Filing Jointly 2022-2023. The IRS also announced that the standard deduction for 2022 was increased to the following. 2022 Income 2023.

The Kiddie Tax thresholds are increased to 1150 and 2300. The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. 10 of taxable income.

Income Tax Brackets For 2022 Are Set The Tax Rates Of America S Top Earners The Fiscal Times Based On Their Wealth Growth 26 Top Billionaires Paid An Average Income. The Internal Revenue Service recently announced its inflation adjustments to the standard deduction and federal income tax brackets for 2023. Over 20550 but not over 83550.

Tax brackets for income earned in 2022.

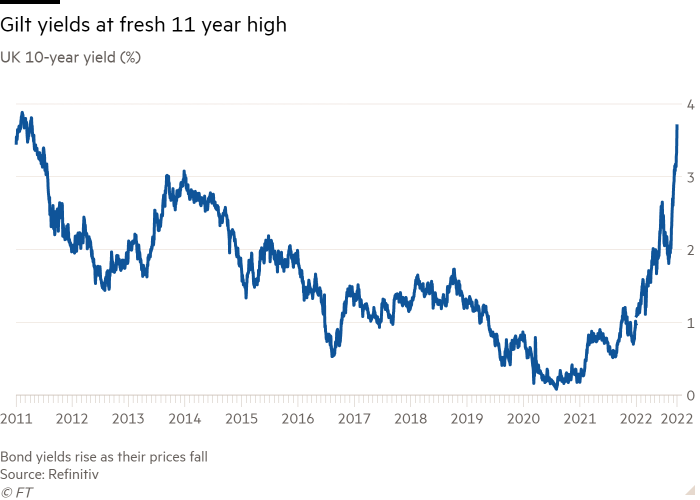

Live News Updates From September 23 Oil Hits 8 Month Low Pound Tumbles After Uk Mini Budget Financial Times

:max_bytes(150000):strip_icc()/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)

How Much Is Too Much To Pay For Tax Returns

Irs Raises Contribution Limits For Retirement Savings Plans Wtop News

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

Nike Fedex Among Larges Us Corporations That Payed No Income Tax 9news Com

Tax Strategy Partnership Agreements Need To Reflect The New Audit Regime Now Accounting Today

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

Gms Flash Alert Tax Kpmg Global

2022 Income Tax Brackets And Standard Deduction

President Biden To Unveil New Tax On Billionaires In Budget The Washington Post

The Irs Has Sent Nearly 30 Million Refunds Here S The Average Payment

Irs Unveils 401k Contribution Limits For 2023 Syracuse Com

Biden Unveils Infrastructure Plan With Corporate Tax Proposals Baker Tilly

Irs Unveils Federal Income Tax Brackets For 2022 Syracuse Com

Over 6 Million In 2016 Tax Refunds For Delawareans Still Available From Irs State Of Delaware News

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

Irs Form 5329 Reporting Taxes On Retirement Plans Smartasset Blog

Irs Announces New Tax Brackets And Deductions For Tax Year 2022